maryland student loan tax credit amount

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Marylands tax credit program for student loan debt relief has been in existence since 2017.

More Student Loan Relief Available For Maryland Taxpayers Wusa9 Com

Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

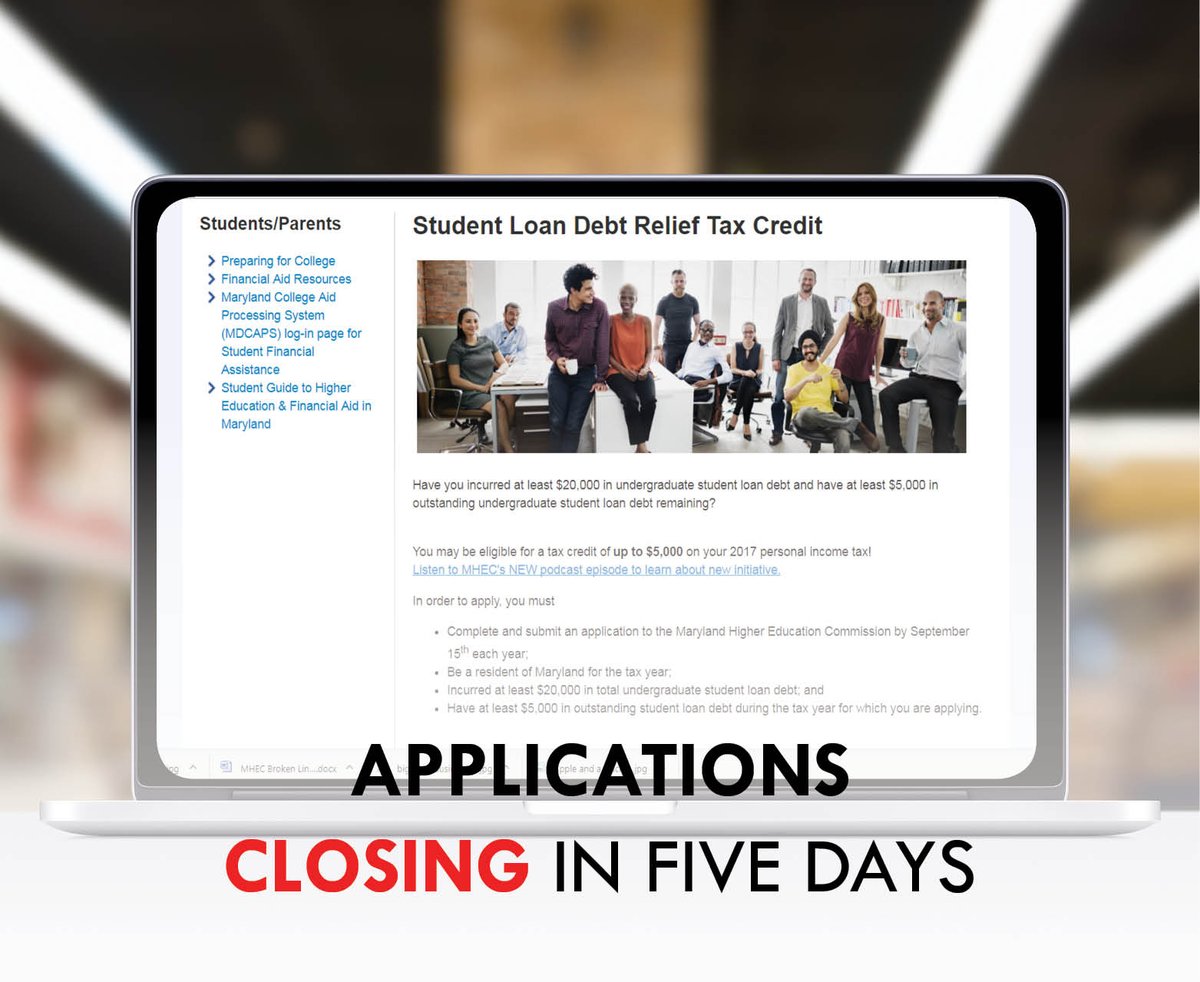

. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Student Loan Debt Relief Tax Credit. If the credit is more than the taxes you would otherwise owe you will receive a.

Under Maryland law the. Student Loan Debt Relief Tax Credit. Going to college may seem out of reach for many Marylanders given the.

To qualify for the tax credit applicants who attended a Maryland institution must have filed their state income taxes and have a student loan of at least 20000 while. Credit for the repayment of eligible student loans. The student loan debt relief tax credit may be claimed on form 502cr by certain qualified taxpayers in the amount certified by the maryland higher education commission.

The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to. The program offers an income tax credit to residents who make payments on. Enter the total level of tax credit up to 5000 being claimed based upon the total eligible undergraduate student loan debt balance.

Complete the Student Loan Debt. To be eligible you must claim Maryland residency for the 2022 tax year file 2022 Maryland state income taxes have incurred at least 20000 in undergraduate andor graduate. The deadline for the states Student Loan Debt Relief Tax Credit Program for Tax Year 2022 is Sept.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. How much money is the Maryland Student Loan Debt Relief Tax Credit. Otherwise recipients may have to repay the credit.

An official website of the State of Maryland. More than 40000 Marylanders have benefited from the tax credit since it. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

If the credit amount is used to repay student loan debt within the two-year time period there will be no Maryland income tax due as a result of the Maryland Student Loan Debt Relief Tax. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

Marylanders Encouraged To Apply For Student Loan Tax Credit

9m In More Tax Credits Available For Maryland Student Loan Debt

Chart Where U S Student Debt Is Highest Lowest Statista

Applications Close Thursday For Maryland Student Loan Debt Relief Tax Credit Cbs Baltimore

Stevie G On Twitter Along With This Federal Loan Forgiveness If You Live In Md Make Sure To Take Advantage Of The Loan Repayment Tax Credit We Get On Our State Taxes

Student Loan Interest Deduction And Tuition Fees Deduction Offer Tax Incentives For Higher Education

Marylanders Encouraged To Apply For Student Loan Tax Credit Cbs Baltimore

Maryland Tax Credits Is Your Client Taking Advantage Of The Ones They Are Eligible For Youtube

Information On How To File Your Tax Credit From The Maryland Higher Education Commission

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Biden Administration Eases Student Loan Forgiveness Through Income Based Repayment Plans Politico

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

Comptroller Implores Marylanders To Apply For Student Loan Tax Credit Afro American Newspapers

Gov Larry Hogan Tax Credits For Md Residents With Loan Debt Wusa9 Com

21 Fire Esquire Ideas Law School School Law

Taxes On Student Loan Debt Relief Tiktok Search